What Does Investment Consultant Do?

What Does Investment Consultant Do?

Blog Article

The Best Strategy To Use For Ia Wealth Management

Table of ContentsThe Main Principles Of Independent Investment Advisor copyright Getting My Financial Advisor Victoria Bc To WorkThe Single Strategy To Use For Private Wealth Management copyrightThe Definitive Guide for Ia Wealth ManagementThe Ia Wealth Management IdeasThe Ultimate Guide To Investment RepresentativeAn Unbiased View of Ia Wealth ManagementThe Basic Principles Of Independent Financial Advisor copyright Fascination About Lighthouse Wealth Management

They generate cash by charging you a charge for each trade, a set fee every month or a share paid in the dollar number of possessions becoming managed. Buyers looking for the best specialist should ask a range concerns, such as: A financial consultant that works well to you will not function as the same as a financial consultant who deals with another.Dependent on whether you’re looking a wide-ranging economic strategy or are merely finding investment advice, this concern are crucial. Economic advisors have actually various methods of charging their customers, and it'll usually depend on how many times you use one. Definitely ask if advisor follows a fee-only or commission-based system.

Financial Advisor Victoria Bc Fundamentals Explained

Even though you may prefer to place in some try to find the correct financial expert, the work may be worth every penny when the advisor provides good advice and helps place you in a much better financial position.

Vanguard ETF Shares aren't redeemable immediately because of the issuing fund apart from in very large aggregations well worth millions of dollars (https://pagespeed.web.dev/analysis/https-www-lighthousewealthvictoria-com/drv8epdit8?form_factor=mobile). ETFs tend to be subject to industry volatility. When buying or offering an ETF, you'll spend or get the economy cost, which can be almost than net advantage price

Retirement Planning copyright - Truths

Usually, however, a monetary expert have some type of training. Whether it’s perhaps not through an academic program, it’s from apprenticing at a financial advisory company (https://www.quora.com/profile/Carlos-Pryce-1). Individuals at a strong that nonetheless learning the ropes are often known as colleagues or they’re the main management staff. As mentioned earlier in the day, though, a lot of experts come from various other areas

Unknown Facts About Private Wealth Management copyright

This means they must put their clients’ desires before unique, among other things. Some other monetary advisors are members of FINRA. This does imply that they are agents who additionally give investment advice. Rather than a fiduciary requirement, they legitimately must follow a suitability criterion. Therefore discover an acceptable foundation due to their investment advice.

Their particular labels usually state everything:Securities permits, on the other hand, tend to be more regarding the sales part of trading. Economic advisors that happen to be additionally agents or insurance rates agents tend to have securities permits. Should they directly purchase or sell shares, bonds, click here now insurance coverage services and products or offer financial guidance, they’ll want specific licenses related to those services and products.

Some Of Tax Planning copyright

Constantly be sure to ask about monetary analysts’ cost schedules. To locate this information all on your own, visit the firm’s Form ADV which files with all the SEC.Generally conversing, there's two different pay buildings: fee-only. independent investment advisor copyright and fee-based. A fee-only advisor’s main as a type of compensation is via client-paid costs

Whenever attempting to understand how much an economic consultant expenses, it's important to understand there are a number of compensation practices they may use. Here’s an introduction to everything you might come across: economic analysts will get paid a portion of general assets under management (AUM) for dealing with finances.

Not known Incorrect Statements About Independent Financial Advisor copyright

59% to at least one. 18percent, normally. investment consultant. Generally, 1per cent is seen as the industry requirement for a million bucks. Lots of analysts will lower the portion at greater levels of possessions, thus you’re investing, state, 1per cent when it comes to basic $one million, 0. 75percent for the next $4 million and 0

Whether you require a monetary expert or not depends upon just how much you have got in possessions. You should also consider the comfort level with money administration topics. If you have an inheritance or have recently come into a large sum of cash, then a monetary specialist may help answer your monetary concerns and manage your money.

The Only Guide to Investment Consultant

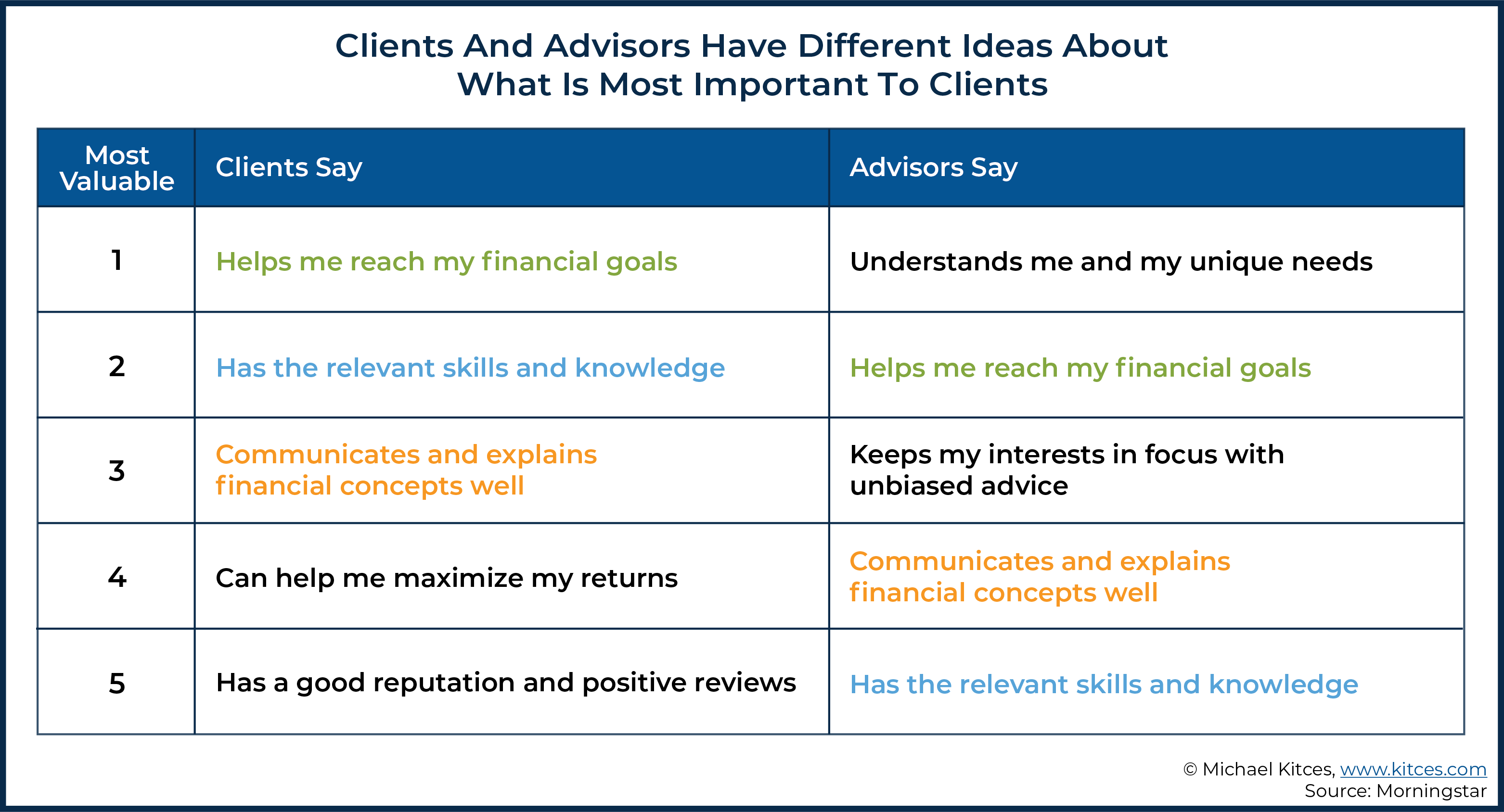

Those differences could seem clear to people within the investment industry, however, many customers aren’t familiar with all of them. They may contemplate economic preparing as compatible with expense administration and information. And it also’s correct that the traces between your vocations have cultivated blurrier in earlier times couple of years. Investment experts are increasingly dedicated to providing holistic economic preparation, as some customers look at the investment-advice piece become pretty much a commodity and are searching for wider expertise.

If you’re looking for holistic planning guidance: a monetary planner is suitable if you’re seeking broad financial-planning guidanceon your financial investment profile, but other parts of one's strategy at the same time. Look for those people that call themselves economic planners and have prospective planners if they’ve received the certified financial coordinator or chartered economic consultant designation.

See This Report about Financial Advisor Victoria Bc

If you would like investment information first off: if you believe debt plan is during good shape general nevertheless need assistance choosing and overseeing your own financial investments, an investment specialist will be the route to take. These types of individuals are frequently subscribed financial investment analysts or have employment with a company which; these advisors and advisory organizations take place to a fiduciary criterion.

If you wish to assign: This setup makes sense for very active those who merely do not have the time or tendency to participate from inside the planning/investment-management process. Additionally, it is something to start thinking about for more mature buyers who will be worried about the possibility of cognitive decrease and its particular effect on their ability to control their particular funds or expense profiles.

The Basic Principles Of Lighthouse Wealth Management

The author or authors you should never own shares in any securities mentioned in this specific article. Know about Morningstar’s editorial guidelines.

Just how near one is to retirement, as an example, or even the impact of major existence activities such as for example marriage or having kids. However these exact things aren’t under the command over a monetary planner. “Many happen randomly and they aren’t one thing we are able to impact,” states , RBC Fellow of Finance at Smith School of Business.

Report this page